How Much Should You Be Worth? Many Paths to Becoming a Multi-Millionaire! (March 7, 2017)

5 incredibly detailed realistic examples of becoming a multi-millionaire

Reading time: 33 minutes.

WSPArchive: We present you with 5 very detailed, practical (some even boring) examples of becoming a multi-millionaire. Nowhere else on the internet will you see such content.

Executive Summary

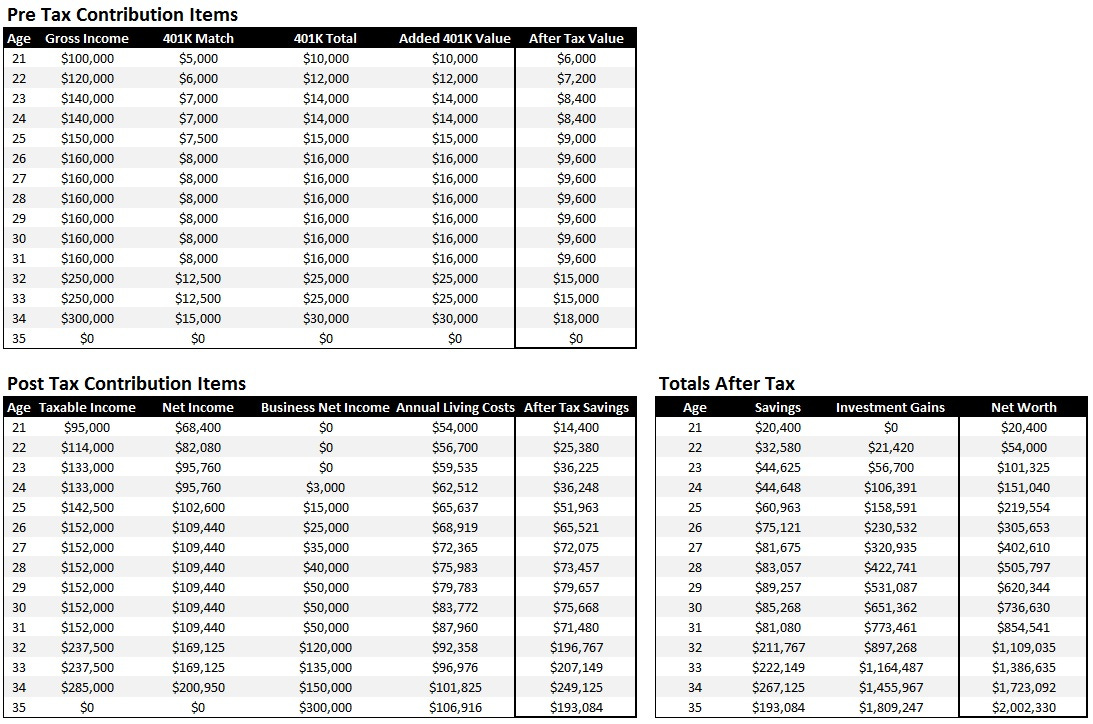

Example 1: Mixed Income Stream

Example 2: The Career Man

Example 3: The Entrepeneur

Example 4: Startup + IPO

Example 5: Extreme Entrepreneur

As our readers know, we don’t tailor our writing to regular people and instead focus on ambitious individuals interested in living an exciting life.

Everyone has a different lifestyle they are looking to maintain and we’ll go ahead and provide a framework for how we think each year should stack up at minimum.

We give up at 35 years old since no one should be giving life advice to someone in that age bracket (they’ve already made their decisions).

Assumptions

100k or Bust

1) The first assumption we make is that you’re going to generate at least $100K a year out of the gate. If you’re working on Wall Street, within Enterprise Sales or in Silicon Valley, this is absolutely attainable.

This is what we have recommended for a long-time in terms of a starting career.

Post Tax

2) Next, we assume that your net worth is calculated on POST tax money.

We think it is a fraud to include $1 million in a 401K as $1 million to your net worth (it’s likely closer to $700K if we assume a 30% tax rate).

To keep this estimate conservative, we assume all money in your 401K is worth 60% of the face value (40% tax rate).

2) We also assume that you will get a 5% 401K match. This is a rough estimate and we assume you’re not going to invest in excess of the match because you have better things to do with the money (primarily starting a business)

Basic Tax Brackets

3) We use basic tax brackets since we don’t know where you live. Specifically we’ll assume everything up to $200,000 is taxed at 28%, everything between $200,001-$400,000 is taxed at 33% and everything above $400K is taxed at 40%.

As an example, if you made $400K exactly, we assume your tax bill is $122K (this is $200K times 28% and the other $200K times 33%).

Again, this does not perfectly match the tax brackets to avoid perfect calculation and keep it simple.

5% Living Cost Increases

4) We assume that your living costs increase at a rate of 5% per year and you’re going to live with roommates when you graduate in the first place. There is no reason to be a big spender when you’re young since we live by the saying

“learn in your 20s, earn in your 30s, burn in your 40s”.

WSPArchive: Ideally, you learn late 10s/early 20s, earn in mid/late 20s - early 30s and burn starting mid 30s.

5% Investment Returns

5) We assume your after tax investment returns will be 5%. This means the money you have on the sidelines will create 5% in annualized returns every single year.

If you’re dollar cost averaging into the S&P 500 you should be able to generate around 7-10% over the long-run so our 5% assumption is quite conservative.

Assumptions Recap

100k salary

post-tax net worth

basic tax brackets

5% living cost increase

5% investment returns

Example 1: Mixed Income Stream (Most Common)

From what we’ve seen, the most common path is this one.

You start a high paying career

Get burned one year on compensation

Start a side hustle and… voila!

Well over $2 million dollars by 35. Below is how it typically works out.

Age 21

To keep the math simple we’re going to assume you begin working at 21 years old.

This means you’re likely graduating from college (despite costs rocketing higher!).

In addition, we’re going to assume you have $0 in total net worth.

If you’re reading this and are on track to rack up $100-200K in student loan debt, we suggest quitting entirely and reassessing why you’re going down the path of shackles.

Since you’re going down an ambitious path we assume you’ll start with a Base Salary of at least $100K.

This is going to be conservative given the compensation numbers for high earning careers on Wall Street, Silicon Valley and Enterprise Sales.

This is going to be a terrible year.

You’ll realize that the cost of living alone is likely around $54,000 at minimum even when you live cheaply.

Your after tax savings will likely be a smidge higher than 20%.

WSPArchive: Living is expensive. Get used to that idea because it’s true, especially in a western world where financial repression and inflation through money printing is increasingly becoming the norm.

Age 22

To keep you motivated most companies offer a pretty nice income hike from year 1 to year 2.

This is not because the company likes you. This is because they likely lost money on your participation in the labor force (training costs etc.) and if you leave after year one, they have to write it off as a loss or a bad hire!

Ever wonder why employers care so much about time at a firm? Well, now you know.

They really earn money off of you once you’re up and running, not when you’re green.

We assume you get a 20% hike and because of this you’re still motivated to work.

You put away just over 25% of your gross income - a big step up when you look at the year-over-year change in total after tax savings (59% increase!).

Age 23

At this point most companies give a similar pay raise on a dollar basis.

This is enough to keep employees motivated and they are now in the green on their investment in human capital (you!).

Since you’re still seeing some career progression and you’ve got another wage hike you’re feeling pretty safe in your position making it easy to continue slogging along.

The one thing you do notice is that the people who have been there for about 5 years seem to be more bitter than the younger employees.

Since the dollar amount increase was the same, your total compensation is up 16.67%.

You end up putting away ~31% of your total gross income and your net worth should clear $100K.

Unfortunately, around this time year 3 to year 5 time frame, you’re going to get hit by “the system”.

Age 24

You get one of the following excuses:

we had a bad year as a firm or group

you’ve been getting solid raises so you should take one for the team

we don’t know if you’re ready for the next change in role

It does not matter what the excuse is. Your compensation is going to be flat.

It could be up (barely) but the point is the same, you realize that you’re a COG in a system that doesn’t care about you at all.

Hopefully this terrible conversation happens earlier rather than later in your career.

This is because you’ll have the energy and motivation to do something on your own.

You’ll strike out and do something small (typically freelance consulting) and make a few bucks with minimal effort.

Total savings is still in the low 30% range.

Age 25

You get a small hike, but the move is not great. You’re realizing that you’re solidly in the center of the “triangle” within the firm where it is hardest to move up.

Everyone wants you to quit or fail because it will lead to less competition for them over the long-term.

You stick it out anyway and realize that it will be a while before your next “step function” upward in compensation. The silver lining is you can continue to freelance.

Your time is spent either freelance consulting or you’ve figured out that you can start a full business selling products!

The result is largely the same, you focus more on your business and generate well over $1,000 a month.

Not bad!

Total net worth goes to $200K!

Age 26

You’re solidly stuck in the middle of the Company/organization.

You look around and everyone in this bracket between 26 and 32 or so years old makes the same.

It’s depressing to see and you realize if you jump firms… well it’s going to be the same story!

May as well remain in the same Company if you’re plugged in from a political perspective.

Besides, working on your business makes the most sense given the returns you’ve seen over the last two years.

You begin shirking a tad at work, cutting corners when needed and grow your small side business to $25K in total profit.

It’s now generating a *near* living wage!

You don’t have time to burn your cash since you had to work hard to get here.

Net worth $300K

Age 27-31

This is probably the most painful bracket.

You’re going to be doing the same mundane work for the vast majority of the time.

The guys you want to replace won’t quit and there is no slot for you to fill.

Your only upside is from your company.

It’s tough to stay focused because the business you’re running cannot be scaled easily due to your current necessary career schedule!

You’re going to feel like you’re chewing through a concrete wall.

The good news is that you’ll be able to chew through the walls without killing yourself. You’ll grow the business to an official near living cost profit pool of $50K by the time you’re 31. Lucky for you, since you have a career still it’s pure profit!

Net worth $850K+

Age 32

For some reason this happens.

When you’re about to quit because you see the light at the end of the tunnel you’re given some change in role.

Think about it like this…

If you were smart enough to realize you’re being underpaid…

and were smart enough to start something…

you’re probably a better worker than those guys slogging in long hours with nothing else going on!

You’re hard working or you’re smart. You can’t be both.

For fun, we’ll assume you get promoted to a new role and your business takes off at the same time.

This creates a tough situation for you because you’re not about to walk away from that high income boost and you can cover your living costs off of your business!

You typically stick around “just one more year… just one more year…”.

Age 33-35

Your business cannot move anymore. It’s growing at a minimal rate of just 10%.

Your income from your career is still the majority of your earnings.

The problem is that working for someone else is becoming a hassle. You can’t stand taking any orders.

Everything at work makes you annoyed and you’re going to take your foot off the gas more and more.

They typically try to motivate you with more money but at the end of the day, you get blown out once they realize you’re not tied to them.

Reminder. Under no circumstances does anyone know what you’re doing.

You simply get blown out around 34.

The best part? Your business ends up benefitting because you never really focused on it. Typical net worth?

Multi-millionaire at $2M bucks

Success Story Comment

ownmyhood says

March 8, 2017 at 5:50 pm

What a coincidence, 20 minutes ago I walked out of my bosses office after letting him know I’ll be leaving the firm (to focus on my biz). I’m in my early 30’s and am a millionaire.

Kind of sad I’ll only be able to feel this way once…

It’s amazing how much my late 20’s early 30’s resemble the “mixed income stream” model you guys posted. Gave me chills.

Early 20s not so much, but a couple years as a starving artist brought things into focus (I’d be an example of someone who “turned it around” at around 24-25).

Anyway, if any youngin’ in their early 20’s asked me how to become a millionaire (and I thought they had any potential, which few do) I’d send them this article. Pure gold.

RE Guys Explains Being Screwed & Business Partners

RE Guy says

March 8, 2017 at 10:28 pm

A predictable issue in my mind is that a young, naive, ambitious, and hard-working guy will assume that he can:

“give it his all”

create a ton of value

and both him and his employer can make plenty of money.

The problem is that often the employer is focused on himself while manipulating the employee.

It can be weakness, ignorance, sloth or plain malice, but the employer will almost invariably screw over the employee at some point. And it goes without saying, so may business partners.

It can seem strange when that person thinks:

“If we just cooperate and work hard together, we’d both make more money than this little bit you’re screwing me for?!”

And they are right, many people sacrifice long-term gains for short-term by doing this.

When it happens, rather than stay discouraged, the employee needs to see it as a signal to become self-sufficient and remain motivated in developing their own income streams.

The issue is that emotionally the employee has expended a large amount of energy towards building something that isn’t theirs, so they will feel that loss as sapping their motivation, at the time when they most need to stay focused, disciplined, and pursue a clear vision.

Being young, having more natural energy, and seeing your life as fully in front of you helps, as stated here.

And importantly, having someone point this out here so that they can expect it, be prepared for it, and thus not have their enthusiasm drained (and perhaps use it as fuel for even more enthusiasm), helps.

And, by building up their other income stream(s) already so they have another venture to pivot into already, is even better.

ownmyhood says

March 9, 2017 at 3:12 pm

“And it goes without saying, so may business partners.”

Luckily, I saw multiple partnerships dissolve (not pretty) before starting my own biz and recognized that going into business with a partner is usually not a smart move, unless:

You and the person you’re partnering with have totally complimentary skill sets.

You and the partner are family members who have gotten along well your entire lives and know essentially everything there is to know about one another.

It seems most partnerships formed by fledgling business owners are created out of fear: it feels safer to take that initial leap together.

Then, once the business takes off and the fear subsides, almost inevitably, one partner will feel slighted.

Another common reason for partnering is one person contributes the capital, the other person does the work. Tempting for a broke young person with a lot of ambition, but largely set up to fail, regardless of the venture’s level of success.

WSPArchive: The rest of this content is paid. You can subscribe with a 7-day trial to see it.

Why Subscribe?

NOTE: Previously this was accidentally pay-walled. It is not anymore.

Regular People will say: How can you charge money for a free blog? I can access it via the web archive. If you ask that question, you should just close this page right now as this blog isn’t for people who cannot do basic value calculations. We are happy to alienate low-quality readers.

Keep reading with a 7-day free trial

Subscribe to Wall Street Playboys Archive to keep reading this post and get 7 days of free access to the full post archives.